The 3-Minute Rule for Advisors Financial Asheboro Nc

Wiki Article

The Main Principles Of Financial Advisor Near Me

Table of ContentsThe Best Guide To Advisor Financial ServicesThe smart Trick of Financial Advisor Job Description That Nobody is DiscussingFinancial Advisor Definition for BeginnersThe Greatest Guide To Financial Advisor Meaning

There are several kinds of financial experts available, each with differing qualifications, specialties, and levels of responsibility. And also when you're on the hunt for an expert suited to your needs, it's not unusual to ask, "Exactly how do I recognize which financial advisor is best for me?" The answer begins with a sincere bookkeeping of your demands and a little of research study.Kinds of Financial Advisors to Take Into Consideration Depending on your economic needs, you might opt for a generalised or specialized financial expert. As you begin to dive into the globe of seeking out a financial consultant that fits your needs, you will likely be presented with lots of titles leaving you asking yourself if you are calling the appropriate individual.

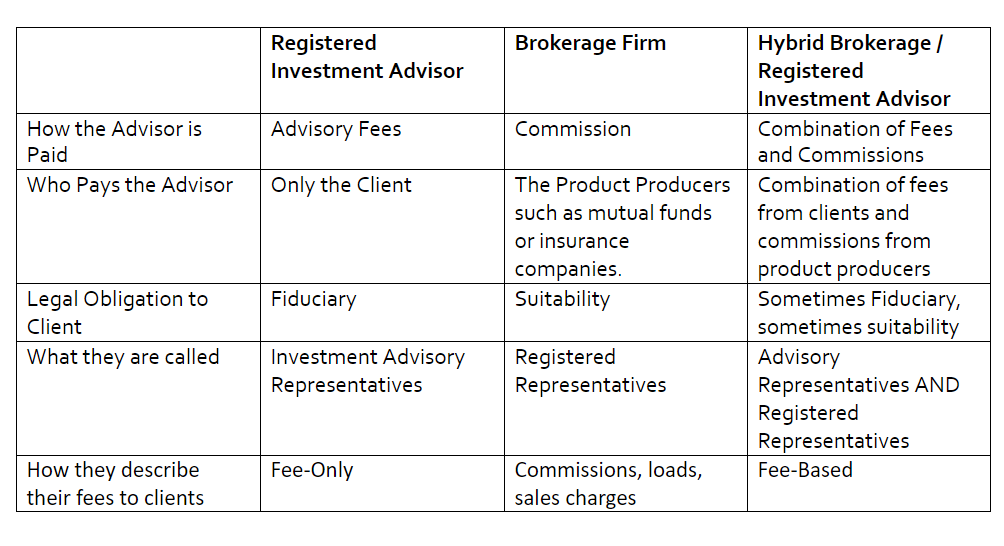

It is essential to keep in mind that some financial consultants likewise have broker licenses (definition they can market protections), yet they are not only brokers. On the same note, brokers are not all licensed just as as well as are not financial experts. This is simply among the many reasons it is best to begin with a qualified monetary coordinator that can suggest you on your investments and retired life.

All About Financial Advisor Meaning

Unlike investment experts, brokers are not paid straight by customers, rather, they gain commissions for trading stocks as well as bonds, as well as for selling shared funds and other items.

You can normally tell an advisor's specialty from his/her economic qualifications. For instance, a certified estate planner (AEP) is an expert who focuses on estate planning. When you're looking for a monetary expert, it's good to have an idea what you desire help with. It's additionally worth pointing out financial organizers. financial advisor salary.

Much like "monetary expert," "monetary coordinator" is additionally a wide term. Someone with that title could additionally have other accreditations or click over here specializeds. Despite your certain needs and financial circumstance, one standards you must highly think about is whether a prospective consultant is a fiduciary. It may shock you to learn that not all financial consultants are needed to act in their customers' benefits.

About Financial Advisor License

To safeguard on your own from someone that is simply attempting to obtain even more cash from you, it's an excellent suggestion to look for an expert who is signed up as a fiduciary. A financial expert that is signed up as a fiduciary is needed, by law, to act in the finest interests of a customer.Fiduciaries can only recommend you to utilize such items if they believe it's actually the best economic decision for you to do so. The United State Stocks and also Exchange Payment (SEC) manages fiduciaries. Fiduciaries that fail to act in a client's best passions can be hit with penalties and/or imprisonment of approximately one decade.

However, that isn't due to the fact that anybody can obtain them. Receiving either qualification requires someone to undergo a range of courses and examinations, in enhancement to gaining a collection amount visit this page of hands-on experience. The result of the accreditation process is that CFPs as well as Ch, FCs are skilled in subjects across the area of individual finance.

The cost can be 1. Costs generally lower as AUM rises. The option is a fee-based expert.

Rumored Buzz on Financial Advisor

A consultant's monitoring cost may or might financial advisor brochure not cover the costs linked with trading safeties. Some advisors likewise bill an established fee per transaction.

This is a solution where the advisor will certainly bundle all account administration costs, including trading costs as well as expense proportions, into one detailed cost. Due to the fact that this fee covers more, it is usually more than a charge that only includes monitoring and excludes points like trading costs. Cover charges are appealing for their simpleness however likewise aren't worth the expense for everyone.

While a typical consultant usually bills a cost in between 1% as well as 2% of AUM, the fee for a robo-advisor is usually 0. The big trade-off with a robo-advisor is that you often don't have the capacity to speak with a human consultant.

Report this wiki page